In a world where the economy can be as unpredictable as a cat on a skateboard, many people look for safe and reliable ways to grow their wealth. Enter precious metals – gold, silver, platinum, and palladium. But is investing in these shiny assets a smart move or just another old-school myth? Let’s break it down in simple terms!

Why Do People Love Precious Metals?

Precious metals have been valued for centuries. From ancient civilizations to modern investors, everyone seems to love a bit of sparkle. But why?

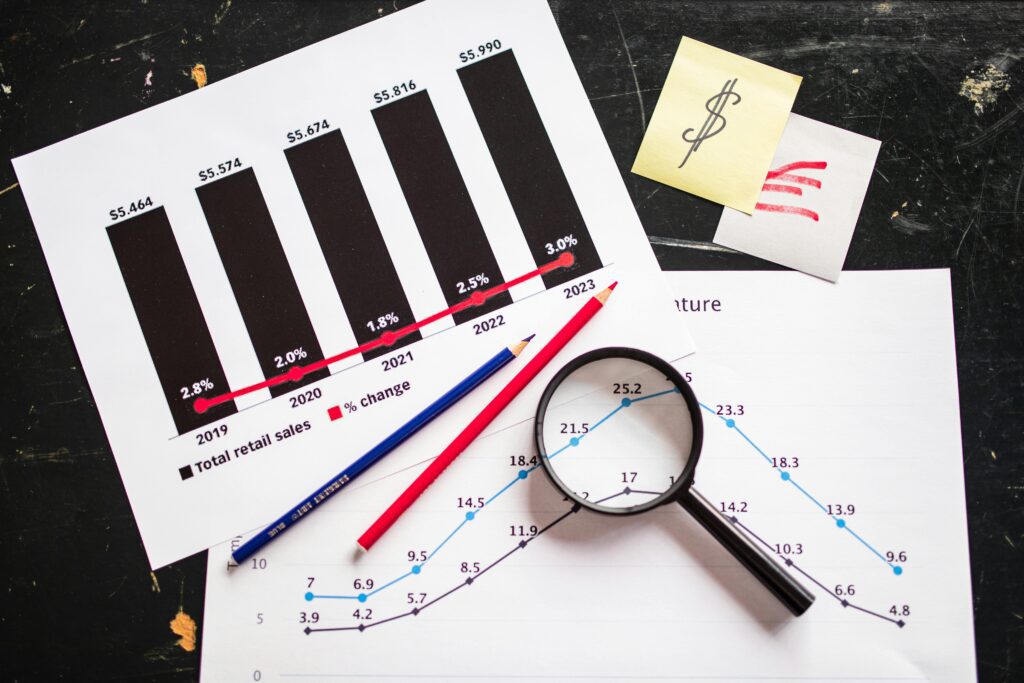

✅ Store of Value: Unlike paper money, which can lose value due to inflation, gold and silver have stood the test of time.

✅ Safe Haven Investment: When the stock market goes on a rollercoaster ride, investors often rush to precious metals for stability.

✅ Tangible Asset: Unlike digital investments, you can actually hold a gold bar or silver coin in your hand (and pretend you’re a pirate, if you like).

✅ Global Demand: Industries like technology, medicine, and jewelry keep the demand for metals high, which helps maintain their value.

The Downsides of Investing in Precious Metals

Of course, no investment is perfect, and precious metals have their own drawbacks.

❌ No Passive Income: Unlike stocks or rental properties, metals don’t generate dividends or interest.

❌ Storage & Security: You need a safe place to store them, whether that’s a bank vault or a hidden compartment in your bookshelf (spy-style!).

❌ Price Fluctuations: While metals tend to hold value over the long run, their prices can still be affected by market trends.

How to Invest in Precious Metals

If you’re thinking of giving it a shot, here are some ways you can invest:

1️⃣ Physical Metals – Buy gold or silver bars, coins, or even jewelry. Just make sure they’re legit!

2️⃣ Exchange-Traded Funds (ETFs) – These allow you to invest in metals without physically owning them.

3️⃣ Mining Stocks – Invest in companies that mine metals; their success is often tied to metal prices.

4️⃣ Precious Metal IRAs – A long-term investment option that allows you to hold metals in a retirement account.

Is It Worth It?

If you’re looking for a long-term, stable investment and like the idea of owning something tangible, then precious metals can be a great addition to your portfolio. However, they should be part of a diversified investment strategy rather than your only asset.

Want to start investing in gold, silver, and more? Check out this trusted platform: Click here to learn more

Final Thoughts

Precious metals have been valuable for centuries, and they’re not going anywhere anytime soon. Whether you’re looking for a hedge against inflation or simply want to add some shine to your investments, gold and silver might be worth considering. Just remember: balance is key!

Would you invest in precious metals? Let’s chat in the comments! 👇💬

Disclaimer:

The content on this website, including product recommendations, reviews, and endorsements, may contain affiliate links. This means that if you click on a link and make a purchase, we may receive a commission at no additional cost to you.

We only promote products and services that we believe will provide value to our audience. However, we encourage you to do your own research before making any purchasing decisions. The information provided on this website is for general informational purposes only and does not constitute professional advice.

We are not responsible for any loss, damage, or other liabilities that may arise from your use of any product or service promoted on this website. Please use your discretion and judgment when purchasing any product or service.

—

Amazon:

King Merchandise is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to www.empowermelife.com